President Donald Trump violates the risks that violate the supply chain for something that does not want to be caught in the risk of Softwood Lumber: Toilet paper.

Item content

(Bloomberg) – President Donald Trump promises to break the supply chain for something that does not want to be caught in Softwood Lumber Risk: Toilet paper.

Item content

Item content

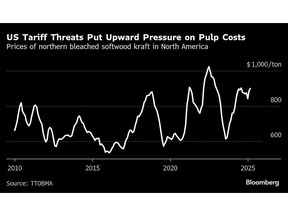

Trump management plans to 27% of the Canadian soft tree lumber almost twice the duty of almost twice the fact that it is possible to push the rate more than 50%. While the Trump is a lawyer to support US production in part for new tariffs, the northern bleaching soft wood can also be a button, which is a button, which has a button, to use the toilet paper and paper towels.

Ad 2

Item content

NBSK, about 30% of the standard US bathroom and is half of a typical paper towel, and currently stems from Canada, which is currently stems from the global pulpation market Brian McClay. He added that the United States focused on the US-American Pulpian-Pulpian-pulp producers in the United States, which stresses the long time, NBSK imported NBSK.

Some of these mills in the United States, some of these large, do not want a soft wood pulp from Canada, they want a soft wood pulp – they have been using this special mill for 30 years, “said McClay.

“If the Canadian Pulp mill is close because of the lack of fiber, I can’t think of another choice for them – they simply cannot turn the recipe around,” he said.

The scenario has peeled the risk of the painful memories of the deficiency of pandemic activist toilet paper, and a naked panic of store shelves. Another opportunity: higher prices on the inspection meter.

Item content

Advertising 3

Item content

Trump promotes a long time to return the length to the United States, and he has repeatedly said that he did not need the Canadian LAMA of his country. However, this position does not take into account the specific qualities of the Canadian Softwood Pulphone, these industrial executives cannot be easily replaced with American alternatives. NBSK is valuable by the power of tension.

“They don’t get our products for our pretty eyes,” he said. “They buy our products because they are most integrated into factories.”

Tariffs also affect the supply chain with a cascading effect. Higher wooden costs may result in reduced construction activities, resulting in less tree collected and reduced wood chips to reduce the resulting pulpation for the production of pulp. This deficiency would manage production costs for tissue manufacturers potentially and cause the supply.

Advertising 4

Item content

If import taxes in Lumber are more than 50%, “Some saws will dismiss and reduce the supply of wood,” said McClay. “Because we will not really cut the tree in Canada, we are dependent on the remnant plugs from the saw. Of course, it will increase the value and will probably reduce access.”

Supply chains woe

Sawmills are difficult to adjust, therefore, usually fully bent or in general, the head of the Quebec Forest Document Council Jean-Fran-Franzois Samray.

“It’s like pipelines, it is like power grids: all is full or all empty,” he said.

The Softwood industry said in a pure and perfect competition market. “Thus, the” reducing production “, which is effective in a market, reducing production, reducing production,” continental supply and student “.

Advertising 5

Item content

For the American Forest and Paper Association, the Vice President for Government Affairs Julie Landry said that the tariffs could not violate “the complex border supply chains” and “the results of the industry should be completed.”

In a long-term trade dispute, it applies fees with more than 14% in the US Canadian Lambon. According to the US Department of Trade, one of them was put to almost 27% of them this year. Many of the White House can be said that about 52% of the 25% tariff limit of Canadian goods.

And this is before the closure of an ordered investigation into national security issues around the wooden imports that can mean more tariffs.

On April 2, the delay in the application of 25% of the assembly in the United States, which is covered by trade deals in the United States will be completed. On the same day, Trump promised to open additional tariffs to trade in the US countries.

Escaling trade voltage has left industrial giants such as Domrar Corp., with pulp and paper products on both sides of the border.

“Canada and the United States benefit from free trade consumers,” said the company’s spokeswoman Antoine Kack.

Item content