Tariffs and a deceleration of the US market in the US market, which is triggered by economic outlook, was considered inappropriate by some credit managers in less than six months ago.

Item content

(Bloomberg) – Tariffs by tariffs were considered inconsistent by some credit managers in the US market, which is triggered by a trigger and slowdown by economic outlook.

Item content

Item content

“China has a bear more bear,” Winnie Caiser said on a podcast on the edge of the loan this week. “Well, how do we try to defend ourselves?”

Ad 2

Item content

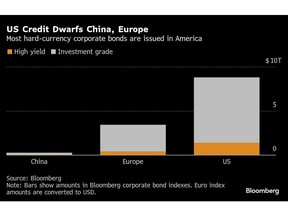

The high-productive credit markets in the United States have implemented the world in the world, which increases the high hopes of economic incentives and regulation after the November President of Donald Trump. Fear of Commerce War is the satisfaction of the broken market, converting this debt to Laggrard. Meanwhile, it is retreated after an increasing increase in the captors managed by China loans, finance and money stimulus.

“Investors can start looking back to China,” he said. The broadcasts also have a little “a little cheap”, although a little rally.

Click here to hear loans’ Caisar discusses global portfolio areas

Chinese corporations this year this year this year this year yields $ 15 billion this year since 2022. Even real estate firms also show signs of life. Beijing Kapital Group, hungry dollars thinks about $ 450 million, a few weeks after the debt of $ 500 million.

Item content

Advertising 3

Item content

Cisisar notes that the interest of investors in Chinese technology companies is growing. Search engine Baidu Inc. This month, today since 2021, since 2021, he sold 10 billion yuan-denomination bonds.

To make sure, the property is still seen as a risk. And Asia’s largest economy is exposed to any escal in trade wars, and as a result, the United States will be subject to any economic crisis.

“The only US tariffs are not postponed or relieved, on February 4 and March 4,” said Pavel Mackel, Global FX Research on HSBC Holdings PLC Pavel Mackel. “After graduating from various opinions of the US management in China, more tariffs or other actions are likely to be declared. Therefore, the Tariff-induced depreciation pressure is still very high in Renminbi.”

A market analyst in the management of Jupiter Assets Xuchen Zhang is careful about the market for the Chinese debt given to some issuers.

Advertising 4

Item content

In addition, the American corporate debt markets are larger than the others, where large money managers are naturally. However, the Fund Funds Flows Flows Flower promote investors to park more money from the uncertainty of the U.S. policy of flower flower flower and increasing US policy.

And “seemingly good return in 2024 and this year this year is this year since this year,” said Zhang. “We have a higher quality and small investment universe that supports the total price restoration of both fundamental and technical prospects.”

In view of the week

- Unofficial economic consultant in President Donald Trump, a federal tax subsidy for municipal bonds, a step to increase the taxable credit market with additional debt and debt costs for cities and states.

- Both companies in Europe and US President Donald Trump plans to strike a risky corner of the credit market after the economic uncertainty of the trade wars. The UK production company All3Media and French insurance broker April group suggests that the loans in Europe suggested this month, according to the issue. Flop-protection company Rovensa, 1.1 billion euros ($ 1.2 billion) was scheduled to refinance and extend the loan.

- This is still open to the credit market used for many borrowers. A group of banks led by JPMorgan Chase & Co. began with $ 7.4 billion bonds and credit for Bausch Health Cosu. The pharmaceutical company is looking for funding for financing.

- Banks, including Goldman Sachs and Citigroup, started selling 7.45 billion euros ($ 8.1 billion) to purchase a share in the Consumer Health Department of Clayton Dubilier and Rice.

- A group of a group led by the Royal Bank’s Royal Bank, the consultack resulted in a loan proposal to support the purchase of the Berkeley research group after the consultation consulting company.

- Private credit funds, trade wars and geopolitical uncertainty, pour the sleeves and shrinks to win work on liquid peers.

- A Deutsche Bank AG Add Annex 1 Direction Debt, after deciding to return the debt, rose to the highest level in three years.

- After the US retail operator, US retail operator, inflation and rapid competition in Forever 21, the Fast-fashion sector was in Chapter 11.

- A small group of pioneers can be the next big thing in the world of corporate bonds, which can be the next big thing in the world of a trillion dollar in the capital, can be the next big thing in the world of corporate bonds – especially with the agenda of the Donald Trump.

- Wall Street brokers, the insurers began to associate Los Angeles with fatal wild fireers, it can blame a payment from the utility service, and for people who are familiar with this issue.

- Some lenders in WW International Inc. have entered confidentialities with the dietary company, because people are trying to reduce interest expenses to reduce the income of people familiar with the situation.

- Brightspeed, owned by Apollo Global Management Inc., according to the people familiar with the issue, rebuilding the debt burden.

- An ambulance finance that allows the judges of the appeal allowance to enter the water 3 billion pounds ($ 3.9 billion in $ 3.9 billion ($ 3.9 billion).

- Lenders, the default, the creditors, which are $ 150 billion, always stopped to get many pennies, but many are agreed that it cannot be done after the agreement is agreed.

- A group of banks led by JPMorgan Chase, Bausch Health Cosu offered $ 7.4 billion bonds and loans on Wednesday. The pharmaceutical company is looking for funding for financing.

- While a bankruptcy judge finds the last second last rescuer for a part of the 41-year-old clothing chain, 354 gave 21 temporary permitted to start selling in the US store.

Advertising 5

Item content

In the action

- JPMorgan Chase & Co., UBS Group AG Managing Director Jens Becker, as the Bank continues to build joint efforts

- A Fintech firm, Steven Gander, which helps to manage significant risk transfer operations, hires the former head of the former Gandander SA to manage the expansion of Banco Santander SA to the US market.

- According to the Internal Memorial of Ubs, Bloomberg, Oliver Gaunt, ANAS co-chair of ANAS, Ilyer Gauntu, has set Ryan Dawson.

- Management Directors Lisa Byrnes and Matthew Krotter, left at Canaccord Genuity Group Inc. Both were technology, media, marketing and information services in the banking team.

- Saybrook was a investor, a investor, a boring and default municipal investor, the industrial veteran veteran bill, hired a basic strategy to manage the main strategy for widening in separate managed accounts.

- Canadian National Bank, Simon Meagher as Simon Meagher, as director of stable income, was hired by the Director of the Stable Income Director as a deputy manager.

Please help Rhaa RAO.

Item content