Business correspondent, BBC News

US President Donald Trump has introduced a number of tariffs or import taxes – the goods received from the best trading partners of billions of dollars.

Tariffs are applied to some other products imported into the United States and some other products in Mexico, Canada and China – the two countries and the European Union.

Economists warned US tariffs – and those presented in response to other countries were able to put prices for American consumers.

Because the import of taxes, goods to bring goods to customers to move to the cost or reduction of imports, the import of goods selected to reduce.

So can it be more expensive?

Cars

Some cars are among the new 25% import tax applied to Canada and Mexico and are temporarily provided by Trump.

These goals are expected to rise to the price of cars – for the TD economy about $ 3,000 (2300 pounds).

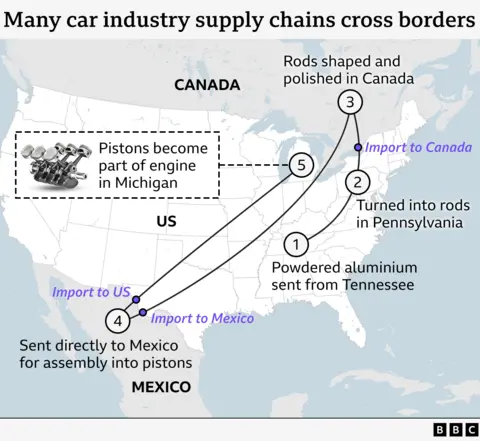

The reason for this has passed several times without collecting parts, Canada and Mexican.

Many well-known car brands, including Audi, BMW, Ford, General Motors and Honda trade parts and vehicles across three countries.

According to imported components, the cost of higher taxes will be given to customers.

“It is enough to say that these trends violate these trends violating through tariffs … will come with significant costs,” TD economy “Andrew Fine.

In the car production sector, he claimed that the “uninterrupted free trade” in decades reduced the prices of consumers.

Beer, whiskey and tequila

Getty pictures

Getty picturesPopular Mexican Beers model and Corona can be more expensive for US customers if they qualify for import taxes for American companies.

However, it is also possible that firms can decide to bring less foreign beers.

Modelo became the number one beer brand in the United States in 2023 and still remains in the best place ever.

The picture is more complicated when it comes to spirits that are mainly released from tariffs since the 1990s.

Industrial bodies from the United States, Canada and Mexico have issued a joint statement of tariffs that say that “deep concern”.

Bourbon, Tennessee, Tennessee Wiski, Tequila and Canadian Visky are known as “different products, and can only be produced in designated countries.”

Thus, if we take into account the production of these drinks, it can simply be transferred, the supply may cause price increase.

The bodies also stressed that many companies have different spirit brands in the United States, Canada and Mexico.

Houses

The United States is imported by a third of the salgosity of the soft tree from Canada, and this basic construction material can be hit by Trump tariffs.

Trump said the United States was more than “more than we ever used.”

However, the National Association of Home Builders called on the president to release the construction materials for the “harmful effects of housing for housing.”

The industrial group has “serious concerns” that tariffs related to wood can increase the cost of building houses outside wood, mainly in the United States – also builds new houses.

“Consumers end up to pay for tariffs in the form of higher home prices,” consumers said.

Import from the rest of the world can also be affected.

On March 1, Trump decided to investigate in connection with the placement of additional tariffs to the most domestic and wood imports, regardless of the countries of the US countries, regardless of the countries of origin.

The findings are by the end of 2025.

Maple syrup

Getty pictures

Getty picturesAccording to Thomas Sampson, the “most open” household effect of a trade war with Canada will be the price of Canadian Maple Sampson, Thomas Sampson from the London School of Economics.

The billion dollar industry of Canada is 75% of the world’s whole maple syrup.

Most of the Sweet Stapan – 90% are produced in Quebec province of Quebec, about 90% – 24 years ago, the world’s strategic reserves are built.

“This maple syrup will be more expensive. The direct price increase in households” said Mr. Sampson.

“If I receive goods that are produced in the United States, but from Canada (used), the price of these goods will rise,” he said.

Fuel prices

Canada is America’s largest foreign oil supplier.

According to the latest official trade figures, 61% of oil oil imported from January-November 2024 came from Canada.

The United States provides a 25% tariff for most goods imported from Canada, Canada energy is 10% lower.

The United States has no oil shortages, but oil refineries are mainly “heavier” from Canada from Canada – thicker – thicker – thicker – thicker – thicker –

“According to American fuel and petrochemical manufacturers, many processing plants need to increase the elasticity of gasoline, diesel and jet fuel production.”

This can push fuel prices if Canada decides to reduce raw oil exports against US tariffs.

Avocados

Getty pictures

Getty picturesAvocados develops in the climate of Mexico.

Approximately 90% of the avocadones consumed in the United States come from Mexico.

The US Department of Agriculture warned that the tariffs of Mexican fruits and vegetables can increase the price of avocadones.

Related foods like Guacamole can also be expensive.

Additional report by Lucy Acheson