One of the highest profile’s copper bulls predicts new price records, because Donald Trump’s threat of tariffs and global shares are seen as an unprecedented opportunities for drainage and trade profit.

Item content

(Bloomberg) – One of the highest profile bulls predicts new price records, because Donald’s TRUC’s tariffs are in danger of tariffs and see them as unprecedented opportunities.

Item content

Item content

Costas Bintas calls on Mercuria Energy Group LTD, which took the lead in the world to the end of the world before 2023, in late 2023.

Ad 2

Item content

The remainder of the most large amount of metal in the United States – and a large number of consumers in China – in a interview that will leave the rest of the world.

“We think something exceptional in the copper market,” he said. “It’s unwise to wait for $ 12,000 or $ 13,000 worth a copper price? I struggle to put a number on it, because it has never happened before.”

Bintas was one of the growing choirs of a traders and investors who predicted a perennial bull market after the coronavirus pandemic. In Mercuria, he united another prolifliif bull: former Goldman Sachs Group Inc, about a year ago about a year ago in 2025 Metals Strategic Nick Snowdon forecasting average prices.

Again, Copper bulls were disappointed several times, recently, when the price is above a ton of above $ 11,000, only Chinese buyers came out of the market.

Dislocations caused by the threat of copper tariffs now changed the market dynamics. Although the United States has still applied extensive tariffs on copper imports, domestic prices have increased to a quarter of the world to create a great incentive to send each spare tone to the United States.

Item content

Advertising 3

Item content

“I have never seen better trade opportunities in the eyes of the tone.”

Inventory changes to the United States means the lack of insufficient shares in the Chinese copper market. Chinese buyers – those who make up more than half of the global demand – will be forced to compete with the US market. At the same time, the large volume of large-scale copper, which usually exits the United States, was effective.

“China has been successful in rejecting high prices as a history.” “This is the first time that another market for the first time in the last date is the first time in China. Therefore an unchanging area.”

Mercuria estimates that about 500,000 tons of copper is directed to the United States, most of them are already on the road. This is compared to normal monthly imports of about 70,000 tons. Traders, a large price on vaccerment, as well as the loads placed for planned supplements to clear customs before applying any potential tariffs.

Mercuria himself has 85,000 to 90,000 tons on the way to the United States. Bloomberg was previously reported that some traders were directed to the transportation of Asian customers to the United States.

Advertising 4

Item content

Bintas is not alone, its bull call. Investment funds, according to the stock exchange data, Since May, LME Bulla has taken its position to the highest level. DrakeWood Capital Management Ltdge Foundation Executive Authority CEO David Lilley predicts China to leave Chinese recipients in the United States.

Global copper prices, this year this year this year this year this year, $ 9,855.50 this year, $ 9,855.50 this year, and futures of US futures, close to the COMEX.

The global market shows some signs of crowding, but still shows the extreme density that the bulls predicted. In the exchange of Shanghai futures, copper moved to the most widely waves, nearby contracts, and then with the indicator of the indicators of deductible materials. In China, copper awards are rising since the end of February, although there are modesty levels with modest levels.

Of course, when a trade war may cause global economic slowdown, a higher increase in copper prices can be opened.

Advertising 5

Item content

Mercuria is not aware of this risk, which predicts the global requirement to be provided with 320,000 tons this year, this year is a large part of the United States this year, the United States can be dried.

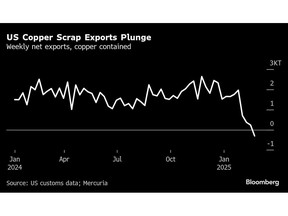

Moreover, the tariff threat has led to the export of copper scraps until dryness. One-third of global copper production comes from scraping and the flower of scraps often operates as a market bumper, when prices are high and are low.

“Already in February, the crumbs of the United States went to the insignificant levels,” said Snowdon, the head of the metal in Merakuria. “You see a shock appreciated in the global copper market through this scrap channel.”

Item content