Before the start of trading day, we give the markets that are likely to carry markets and events. We look at today:

Item content

(Bloomberg) – Before you start trading day, we will deliver the digestion of the main news and events that can move markets. We look at today:

Item content

Item content

- Oil marketing companies

- Air cooling product manufacturers

- Rally in steel stocks

Good morning this is a stock correspondent in Mumbai Ashutosh Joshi. On the fourth day of local capital, this morning is set up on the fourth day of earnings to watch the rallies in the Asian markets and on a night Wall Street. The balance sheet of the federal reserve is expected to slow the PACE and the terms of the chairman Jerome Powell’s comments are expected. Meanwhile, global money managers return to India’s bond market.

Ad 2

Item content

Low oil prices can help buy fuel vendors hit LPG

The shares of state fuel sellers are concerned that the government is causing the concerns that the government cannot compensate for LPG, or cooking gas to cook in low prices. The cargo for the financial year ending March is 400 billion rupees ($ 4.6 billion). However, the last decline in oil prices provided a very need relief. According to the antique stock exchange, the expansion losses in automatic fuel margins can help absorb from a discounted LPG. BPCL and IOC shares earned 4% and 7% this month and 1% while HPCL.

Air conditioners are wrapped to applaud the spring

The shares of air cooling product manufacturers and their suppliers are in this month, in this month, in the summer, in the summer, early start and advance seasonal forecasts in advance. According to Nuvama analysts, the companies carry distributors with the products waiting for a strong demand. Despite strong competition, most of the players have successfully completed the growing copper prices. The main beneficiaries of the volts and blue stars, Havels and Crompton stops to get a higher fan sale for the pasture conditioning segment. Between Suppliers, Nuvama is drowning in Amber and PG Electroplast.

Advertising 3

Item content

Step Stocks prepared to extend the final gains

After the beginning of the year, India steel producers see more brighter prospects after the country’s proposal to receive 12% protection fees in all imports. Since December, it is expected to further increase local prices in more than 5%. Analysts are waiting for the sector updates for the sector, although most of these optimism. The Nifty Metal Index gets a standard deviation from a historical assessment of one-year advanced earnings already in the 14-fold advantage.

Analysts’ actions:

- Bajaj Finserv Batlıva & Karani’da was cut; Pt 1.960 rupee

- Steel power added new to Emkay Global; Pt 120 rupees

- Tata COMM JM made a new purchase with finance; Pt 2,030 rupees

Today, three bigs of Bloomberg reads:

- The withdrawal of years of years undermine India’s energy security

- Powell lowers growing risks, sees a tariff effect as a transition

- Great Take: Trump reveals a new ‘china shock’ in the rest of the world

And finally ..

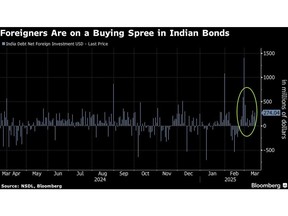

While the foreign capital continues to get out of Indian capital, pours on Rupi-denomination bonds. Global funds have been bonds $ 1.8 billion so far this month – the highest reduction bets by the Life Bank of India since September. On the contrary, they sold more than $ 2.6 billion in connection with the slowdown of economic growth and high assessments. Indian bonds remain attractive due to a positive real productivity and the inclusion of US treasures affordable and into the main global indices.

To play Indian markets every day, follow Bloomberg India in WhatsApp. Register here.

– Subhadip with SyrCar, Chiranjivi Chakraborty and Kartik to help Gurbanal.

Item content