Before the start of trading day, we give the markets that are likely to carry markets and events. We look at today:

Item content

(Bloomberg) – Before you start trading day, we will deliver the digestion of the main news and events that can move markets. We look at today:

Item content

Item content

- Slowly retail

- City Gas companies

- Theme-based funds

Good morning, this is a stock chiranjivi chakraborty in Mumbai. Compatible futures shows a strong opening, places local stocks for a consistent eighth session. Investors focused on foreign stock streams that make them positive among the active classes. From a technical point of view, the ongoing rally, key resistance levels, slowly broken, although it is prone to retreat risks.

Ad 2

Item content

Craze for theme-based funds

The ratio of the new mutual Fund’s floo supplements is better reflected in the retail investor than the impact of the size of the investor. In February, capital funds added the slowest growth for the slowest growth, medium and small caps and thematic / sector funds since November 2023. According to EARA, many new investors in these categories have been a very new investor after the general election results of many new investors and are now sitting on losses. When the Flows is affected by this day, ELA warns that they can slow down in the coming days.

The contract production market was set to quadruple

Scouts for the winners among tectonic changes in the global supply chain are not an easy task. However, as the global pharmacies, the global pharmacies are far from China, see the more beneficial Indian contract firms. The Indian CRDMOOS market expects to $ 12 billion from $ 12 billion to $ 12 billion from $ 12 billion to $ 12 billion in the next decade to $ 12 billion from $ 12 billion to $ 12 billion. Donald Trump’s reciprocal tariffs could create indirect risks for Indian companies.

Advertising 3

Item content

Despite the prospects of growth, urban and gas firms are fighting

Shares of urban and gas distribution companies, Mahanagar gas and indraprastha gas decreased by about 2% on Tuesday, and short-term concerns on the margin of margin retained buyers carefully. According to the Careedge, this is expected to increase about 18% compared to the average annual year, due to the higher volume and better handling lever, in the middle of the average profitability. However, the edges may be under nearby pressure due to the lower division of gas subsidized from the government.

Analysts’ actions:

- JPMorgan restored JSW energy overweight overweight; Pt 500 rupees

- Ambula cements removed to get in UBS; Pt 620 rupees

- Samvardhana was removed to receive Antyson Uluk; Pt 162 rupees

Today, three bigs of Bloomberg reads:

- Modi banks in households in a debt of $ 346 billion

- He said that the United States was in the Black Sea peace, as it removed the terms of Russia

- Great Take: share special capital covets worth $ 12 trillion in 401 (k)

And finally ..

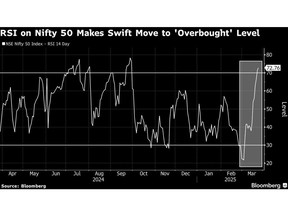

This month, the rally in India’s capital accelerated many technical obstacles in his awakening. For example, the 14-day relative index of Nifty 50 index, at least 14 sessions, in extreme sessions, over the extreme session – in the fastest two decades. This simply shows how the investor’s mind becomes. However, analysts warn that retreat is not immune to retreat – some may be as sharp as recovery.

To play Indian markets every day, follow Bloomberg India in WhatsApp. Register here.

– Help Chiranjivi Chakraborty and Kartik Gurbanal.

Item content