Business correspondent

Getty pictures

Getty picturesWe all heard about Carmaker Ford, but what about disposable rivals Abbot-Detroit, Acme, Adams and Aerocar?

No? Surprisingly, because they all went very early bust. And they are one of the failed car companies that are just beginning with the letter “A”.

We remember the winners who continue to dominate the world’s motor industry and the existing high-tech sector are the same.

Many investors, a century ago supported the wrong horseless carriages and lost their money. Only a few selected Ford or Chrysler, this is what it is now, no matter what, only the technological sector.

Technical shares are widespread, as widespread in the last year, share graphics often resemble rollercoaster walks, even the president’s Trump tariffs have fallen.

According to the principle of the volatility of the volatility of this technological sector, according to Finance Professor Elroy Dimson, the NASCENT automotive industry does not know that such technological companies will win a long time.

“If you return to the beginning of the last century, there were many horrific motor companies, and the cars intended to make a great change,” said Prof Dimson. “But almost every company has bankrupt, you do not know which company you need to buy.”

Of course, all high-tech enterprises do not make money. The size of an investment in shares uses two factors, growth or dividends growth and increase in stock value.

Boring companies can pay a reliable dividend and see the shares gradually increase the value. However, many high-tech companies do not pay much if anything in dividends. Instead, they invest in future growth, and therefore their stock prices are waved based on the hopes of future profits.

Lansdown, Susannah Streeter, a company company in the company’s financial services company, puts it on.

At the same time, investors in such shares gamble on MS Streeter, “Today is the jam of tomorrow, not the jam. They all try to choose the next future winner, which will pay the winner in the future, as a result, which will pay a giant dividend in the future.

Thus, any news or even suggestions that will not be good as the future growth is previously expected can be distributed.

Susnah street

Susnah streetOn the other hand, do not change any good news, current profit or even losses, even the loss of losses, even the loss of the winners. Shares are more volatile because because of not written by current profits or dividends.

This means that Profison puts it, “the minor changes of the growth expectancy, as well as large numbers of companies can affect large changes.

“You have companies with a reasonable similar, so when the growth rates change, a few companies in a similar way,” he says.

“This was not different from the DotCOM BUMU in the early 2000s. There were companies with great growth prospects. And when the growth prospects disappear, they were missing companies.”

In addition, many are also very large high-tech companies today. In America, they are “magnificent seven” – Nvidia, Amazon, Apple, Microsoft, Meta, Facebook and Tesla’s parent are known as “magnificent seven”, alphabetical, alphabet.

Thus, this is very young in the market, because of some of these companies are really very young, and dominant in the sectors where previous leaders crashed and burned. Does anyone remember Ericsson, Boo or Compaq?

Technology, steel production or food production, which is a very fast proportion, and a new technological company has a chance to destroy a new technological company.

Today’s “magnificent seven” will not guarantee that it will remain magnificent and even the same seven companies.

For example, take Tesla, its sales They recently fell in response to two extensive informative factors. First, some potential customers oppose the participation of the President of Elon, the owner of Tesla. Second, Chinese electric car firms like BYD are increasingly strong opponents.

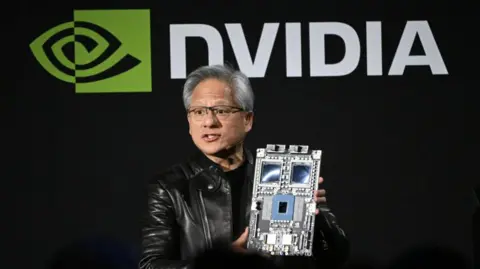

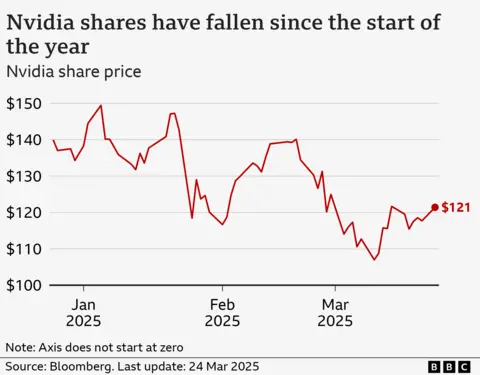

Meanwhile, NVIDIA, Chinese artificial intelligence Chatbot Deepseek’s release was dramatically seen the lower stock price at the beginning of this year. It was reported that this application was created in a part of the value of their opponents.

Deepseek’s instant popularity raised the future of America’s EI dominance and US companies about the investment scale. This is concerned about NVIDIA, because it is on the forefront of preparing microchips for AI processing.

Getty pictures

Getty picturesAI is now the biggest technological game in the city, and it seems that completely everyone claims that the AI has changed its industry, products and interests. They cannot all be true.

Or Profius’ Did you know what cars were at least in 1910, but today for companies that are not good enough to trust the wisdom of the crowd with AI companies. “

All AI companies can not win and Robert Whaley, a financial professor at the University of Vanderbilt in Tennessee. “The AI is undoubtedly contributing to technological volatility. The race continues.”

This means that AI shares are sensitive to predictions. Any sign of a certain firm in the EU race, most investors who do not understand the subject, may mean that it is leaving for another visible.

Then there are visible investors, as they buy shares of companies, as they are in the high-tech sector and spread their risks.

In short, stock prices are always a rational measure in the value of a firm, especially in the high-tech sector or even prospects. Instead, they can represent the optimism of investors. And optimism does not always last.

Often short-term, passing and sprinkled. And sometimes optimism comes to reality or simply face to face with a flat left. This is short, volatile.